TL;DR

- BLP Farm V2 Upgrade: We are introducing a decentralized, automated emissions system that allows users to claim UTS rewards at any time, without needing to wait for the weekly announcement on Thursday.

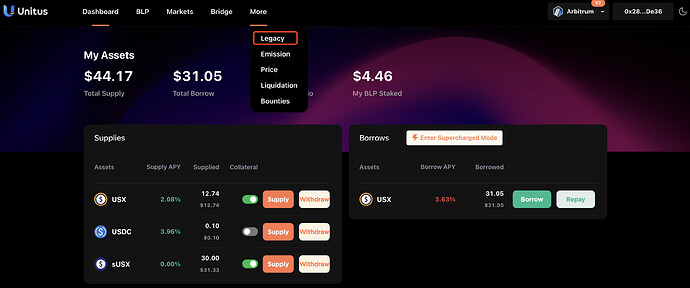

- The BLP page of our dApp was upgraded, with the previous version available at More → Lgeacy.

- Action Required: All users must migrate their BLP to V2 by November 21 at 12:00 PM UTC to remain eligible for UTS emissions.

- Arbitrum Users: Additional steps include migrating LPs from Camelot to Uniswap V2 before staking in the new contract.

Introduction

Unitus is proud to announce the launch of BLP Farm V2, a significant upgrade to its Bonded Liquidity Provisioning (BLP) system. This overhaul marks a shift towards a fully decentralized, non-custodial emissions distribution model, eliminating manual interventions and delays. The upgrade aligns with Unitus’ mission to enhance user experience while driving sustainable growth and adoption of UTS.

To ensure continued eligibility for UTS emissions, users must migrate their BLP to the new V2 contract. This article provides an overview of BLP Farm V2, its benefits, and a step-by-step guide for migration.

What is Bonded Liquidity Provisioning (BLP)?

What is Bonded Liquidity Provisioning (BLP)?

One of the cornerstones of Unitus is its Bonded Liquidity Provisioning (BLP) function, which enables the protocol to distribute emissions only to those who have staked whitelisted LPs (UTS/DF and UTS/USX on the selected DEXes) worth at least 1% of their deposits on the platform. The BLP system enables the protocol to grant:

- User commitment: The greater the liquidity and the longer users stake your BLP with Unitus, the more benefits they can gain access to.

- Interest alignment: BLP enables Unitus users to actively engage in and benefit from the value generated by the protocol, fostering a long-term vision that promotes sustainable growth for Unitus.

- UTS adoption: BLP incentivizes liquidity provision for UTS, which serves to mitigate excessive volatility, ensuring a smoother path to adoption and everyday usability of UTS.

Decentralizing Emissions: introducing BLP Farm V2

Decentralizing Emissions: introducing BLP Farm V2

So far, UTS emissions were handled in a centralized manner through periodical snapshots and a manual weekly aggregation of data to assign emissions conducted by our team. This approach has worked fairly well so far, but it was stoo dependent of our centralized intervention, and sometimes the data gathered would have certain delays and discrepancies.

To address these issues, Unitus is proud to introduce the BLP Farm V2 upgrade, which adopts a decentralized, non-custodian distribution scheme.

Here’s how it works. As outlined earlier in this article, to be eligible for receiving emissions, users have to maintain at least 1% worth of BLP staked compared to their deposits on Unitus. Unlike before the upgrade, if a user’s real-time eligibility state changes from qualified to disqualified (for example, due to price fluctuations), the distribution for this account will not automatically stop. It will only stop when the on-chain eligibility state changes which requires explicitly triggering by transactions. The following actions may lead to this change:

- Bounties hunter liquidates the account, resulting in its exclusion of emission.

- The account stakes (or unstakes) BLP.

- The account claims rewards.

- The account performs depositing/withdrawing in Unitus and simultaneously updates the eligibility state.

With this upgrade, there are no snapshots, no delayed claiming, and no custodians. UTS distribution via BLP staking is carried out in a completely decentralized manner, with users becoming able to claim UTS rewards at any time, without needing to wait for the weekly announcement on Thursday.

Please note that to implement the changes, we have deployed on our dApp a new page for the BLP section which directs users to the new smart contracts. The previous BLP page will always be availabke for users at More → Lgeacy.

Migrate your BLP to stay eligible: a Tutorial

Migrate your BLP to stay eligible: a Tutorial

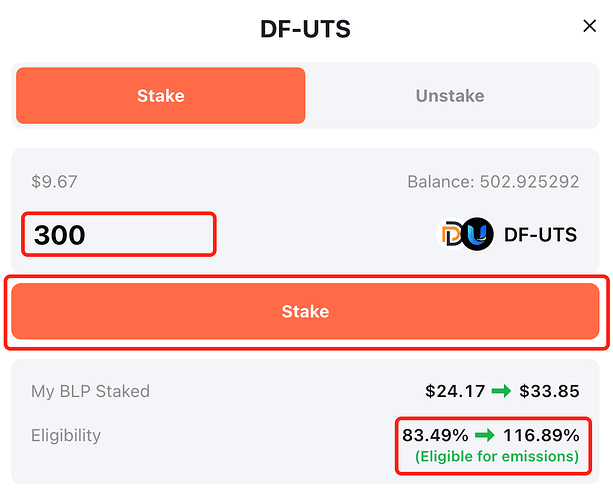

To remain eligible to receive UTS emissions, all users are required to migrate their BLPs to the new V2 contract. Starting from November 21 at 12:00pm UTC, UTS emissions will be distributed only to those who have migrated their BLPs.

Note: if you’re staking BLP on Arbitrum with LPs created on Camelot, it will be required to migrate your LPs to Uniswap V2 on Arbitrum, and then staking them in the new contract. Check the tutorial for more info.

The procedure only takes few clicks, here’s a step-by-step tutorial.

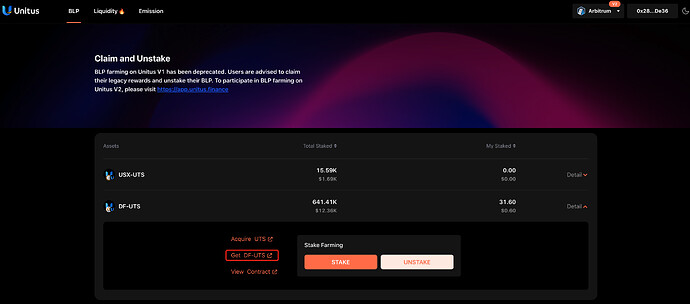

- Visit the Unitus dApp website: https://app.unitus.finance, click More>Legacy, and go to https://legacy.unitus.finance

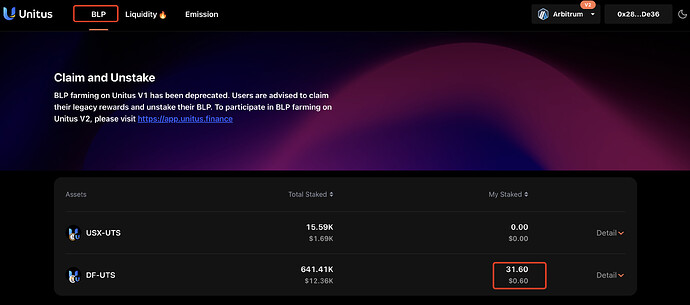

- Enter the BLP page, you can view the number of DF-UTS and USX-UTS BLP staked.

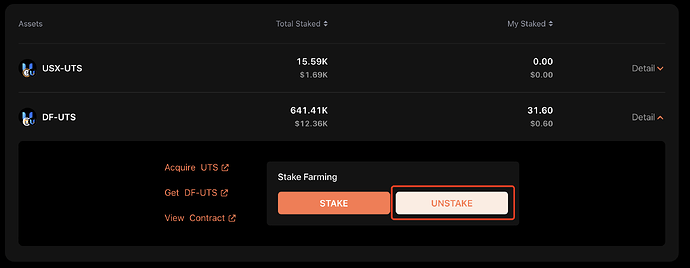

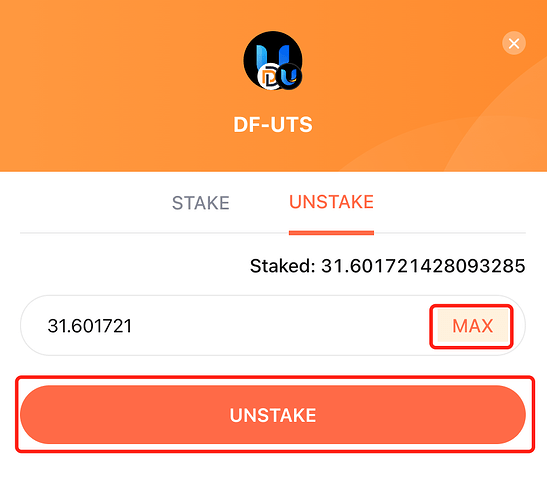

- Afterward, Unstake your LP on Unitus by clicking on ‘UNSTAKE’.

- Click the ‘MAX’ and exit the pool.

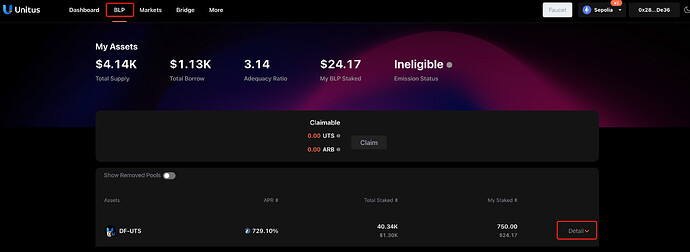

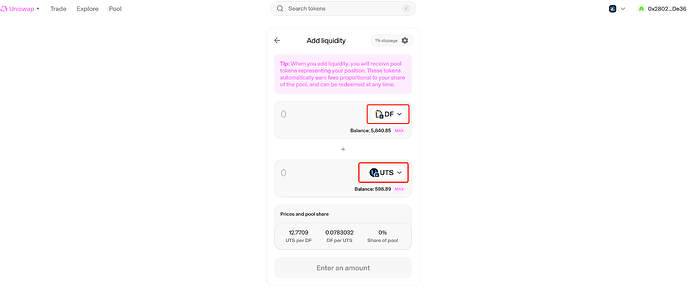

- Return to the Unitus dApp website: https://app.unitus.finance, and switch to the ‘BLP’ tab.

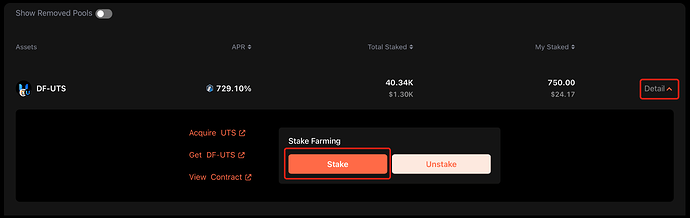

- Expand the menu for quick access to pool for BLP liquidity provision.

- When you enter the amount, you can see the reminder for the minimum BLP required to facilitate your liquidity mining rewards eligibility.

For Arbitrum BLP stakers: mihgrate your BLPs from Camelot to Uniswap V2

Arbitrum network migration BLP also needs to execute #1,2,3,4, and then jump to Camlot to exit liquidity.

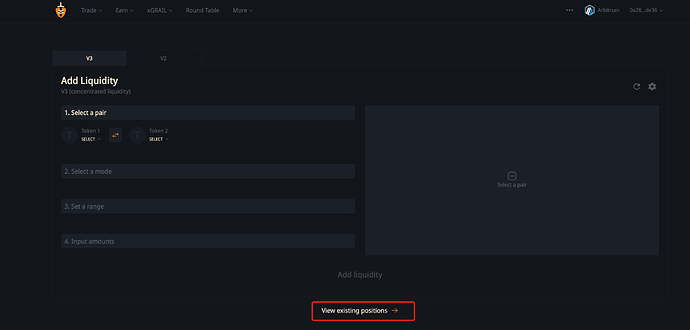

- Click “View existing positions” to enter my positions.

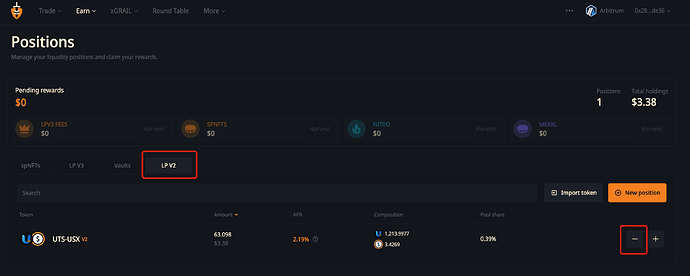

- Select LP V2 and click "-”.

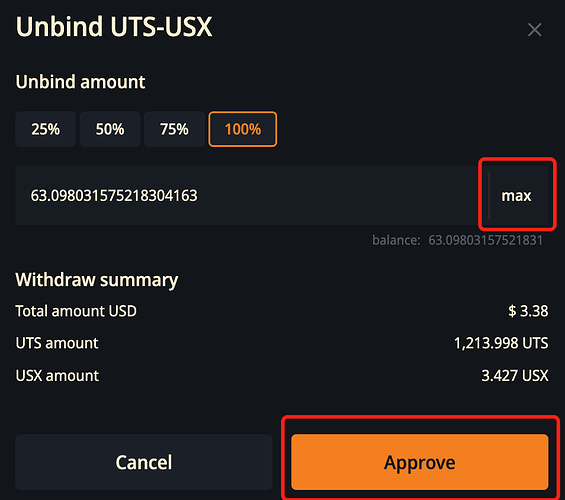

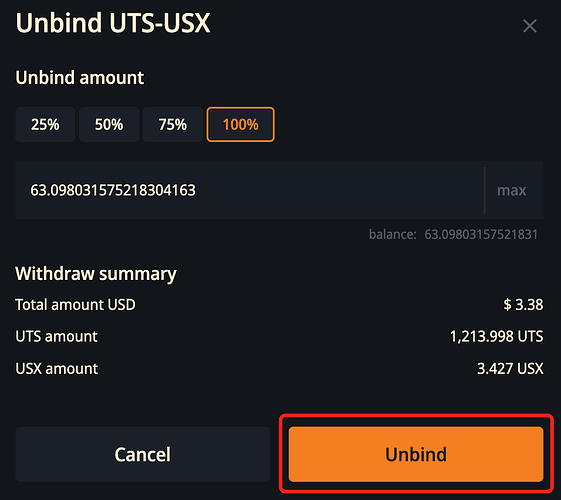

- Select MAX, click Approve signature, and then click Unbind to exit Camlot liquidity.

- This one is for UTS-DF, Navigate to Uniswap, Make sure you enter DF and UTS amount and hit the Add liquidity button and you are Done.

- Then repeat steps #5, 6, and 7 to complete the Arbitrum network BLP Migration.

If you have any questions or run into issues during the migration process, our team is here to help! Join the conversation on Telegram or Discord to connect with our community and support team. We’re excited to have you on this journey as we continue building a stronger, more sustainable Unitus ecosystem!