Emerged from dForce Lending following the dForce X Plan, Unitus is an innovative Lending protocol available on Ethereum, Arbitrum, Optimism, BNB Chain, Polygon, Conflux eSpace, and today also Base!

What is Unitus?

Unitus Finance, formerly known as dForce Lending, has undergone rebranding and evolved from dForce Lending, inheriting all of dForce’s lending features and smart contracts, and marking a significant milestone as the first platform to provide native dForce USX liquidity across multiple L1/L2s.

Unitus Finance offers a range of advantages that distinguish it from existing protocols:

- Multi-chain: Unitus extends DeFi lending & borrowing capabilities to multiple blockchain.

- Cross-chain: Through the integration of dForce’s native USX stablecoin, users can secure omni USX liquidity by using collaterals assets from various blockchain networks.

- Tokenomics: Unitus’ tokenomics and liquidity mining mechanism incentivize long-term liquidity and align interests effectively.

- Capital efficiency: Unitus achieves maximum capital efficiency by enabling higher loan-to-value (LTV) ratios for pegged assets, including LSD assets like wstETH, rETH, cbETH, among others, as well as Real World Asset (RWA) yield assets like sDAI and sUSX. LTV ratios can reach as high as 99%.

- Customized money market for long-tail assets: Unitus introduces an isolated market for long-tail assets with flexible risk parameters.

Users can lend, borrow, bridge UTS/DF/USX across all supported chains, and get rewarded with UTS token on Unitus!

Lend & Borrow on Unitus!

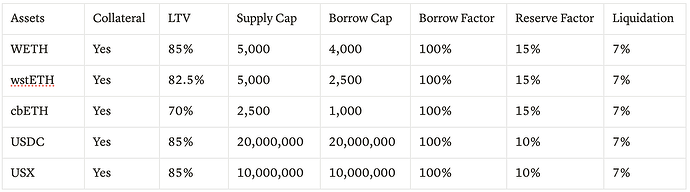

Unitus is launching on Base on April 4th, 2024, enabling deposits and borrowings for the following markets:

Token Addresses on Base

$UTS: 0x3B6564b5DA73A41d3A66e6558a98FD0e9E1e77ad

$USX: 0xc142171B138DB17a1B7Cb999C44526094a4dae05

Frequently Asked Questions

- How can I earn UTS?

Users will be rewarded with UTS token by lending and borrowing on Unitus or by staking iUSX. Keep in mind that the BLP mechanism applies for the distribution of rewards.

- What is the Bonded Liquidity Provisioning (BLP) mechanism?

Unitus embraces a value-driven tokenomics approach. On our platform, users must have at least 1% of their TVL as a BLP, meaning that they have to create liquidity for the UTS/DF and/or UTS/USX pairs on Aerodrome worth at least 1% of their deposit on the platform to earn rewards. Note that these LP have to be staked in the BLP section of the Unitus dapp to effectively unlock emissions.

For example, if a user deposits 1,000 USDC and stakes 1,000 iUSX, they must stake BLP equivalent to $20 in dollar value to be eligible for UTS emission.

-

USDC LM Weighting: 1,000 + 20 * 10 for UTS/DF (or 1,000 + 20*5 for UTS/USX)

-

iUSX LM Weighting: 1,000 + 20 * 10 for UTS/DF (or 1,000 + 20*5 for UTS/USX)

-

What is iUSX staking?

Users can stake iUSX on Unitus to earn UTS rewards

- Is there any lock-up for BLP?

No, users can stake and unstake BLP on Unitus at any time.

However, please bear in mind that you will need to satisfy the 1% threshold in order to become eligible for UTS emission.

- Where can I provide liquidity for BLP?

Check our tutorial here: How to provide Liquidity on Aerodrome

- What yield can I earn on Unitus without BLP staking?

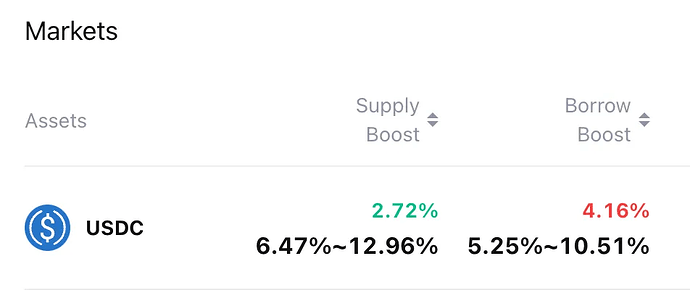

On the dashboard page, you can see the real-time deposit and borrowing rates for each asset:

Supply rate is generated by the borrowing costs paid by borrowers and disbursed to lenders in the same asset. For example, when you lend USDC, you receive USDC in return. Lenders can receive these organic rates regardless of BLP staking.

On the other hand, the boost rate represents what users should expect from emissions, provided they meet the threshold for BLP staking, and it’s paid in UTS tokens.

That being said, with the maximum boost on USDC as illustrated above, a user should expect a 15.68% APY (2.72% + 12.96%) on his/her USDC deposit, translating to a yield 4.76x higher than without BLP staking.

- Where can I see and claim my UTS rewards?

On the ‘Emission’ page, users can see all their UTS rewards, including those claimable at any time (UTS earned before the last snapshot) and pending rewards for the current epoch, which will become available around 12:00 pm UTC each Thursday.

- How much UTS is emitted per day?

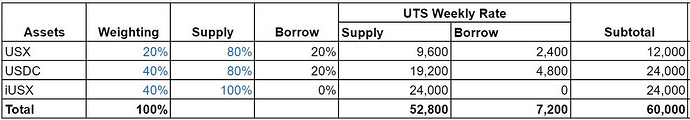

The initial distribution of UTS on Base is as follows:

Supply rate is generated by the borrowing costs paid by borrowers and disbursed to lenders in the same asset. For example, when you lend USDC, you receive USDC in return. Lenders can receive these organic rates regardless of BLP staking.

On the other hand, the boost rate represents what users should expect from emissions, provided they meet the threshold for BLP staking, and it’s paid in UTS tokens.

That being said, with the maximum boost on USDC as illustrated above, a user should expect a 15.68% APY (2.72% + 12.96%) on his/her USDC deposit, translating to a yield 4.76x higher than without BLP staking.

- Where can I see and claim my UTS rewards?

On the ‘Emission’ page, users can see all their UTS rewards, including those claimable at any time (UTS earned before the last snapshot) and pending rewards for the current epoch, which will become available around 12:00 pm UTC each Thursday.

- How much UTS is emitted per day?

The initial distribution of UTS on Base is as follows:

- How to bridge UTS

UTS was built using the LayerZero omnichain token standard. This means that users can bridge it seamlessly directly from the Bridge section of our dApp at Unitus Dapp.

If you have more questions, please refer to our docs or reach us out on Discord or Telegram, all the useful links are below.