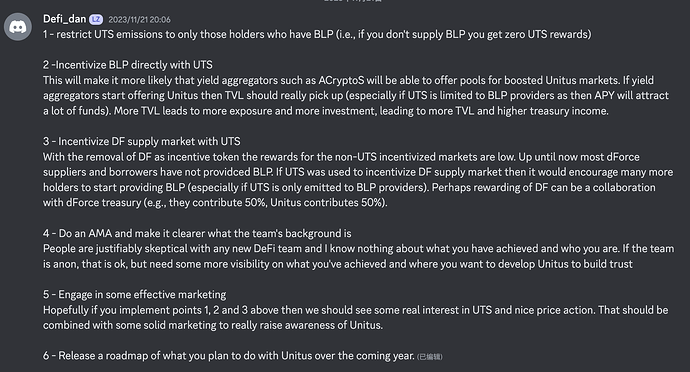

It’s a great start for the Unitus liquidity mining, we also gather quite a bit of comments from the communiy, i.e from defi-dan, such as below:

To incorporate some of the community feedback, below is my proposal:

-

Implementation of Mandatory BLP Threshold:

The original plan to implement a mandatory BLP threshold was temporarily delayed due to the limited UTS supply in the market, which could potentially discourage BLP acquisition.

However, based on the data analysis from epoch 1, we acknowledged that implementing a mandatory BLP threshold is crucial. I propose that we initiate the mandatory threshold at 1% of the user deposit, with the percentage growing as more emission enters circulation.

A 1% starting point implies that users are eligible for UTS emission only if they provide at least 1% of their deposit (in the dollar value) of BLP (either UTS/DF or UTS/USX). For instance, a user deposit of $10,000 ETH and $5,000 USDC would require providing $150 BLP minimum to be eligible for UTS emission.

-

Creation of iUSX Staking Market for UTS Emission:

We noted the high leverage on the USX lending market, indicating recursive USX deposit/borrowing for UTS mining, this is not organic; We proposed to introduce iUSX staking for UTS emission. This aims to address the inefficiency caused by excessive borrowing and encourages more USX minting via LSR. The suggestion is to allocate more emission to the iUSX staking market.

-

Reallocation of UTS Emission:

We propose to re-allocate more UTS emission from the USX borrow/lending to iUSX staking.

-

Adjustment of Supply/Borrow Allocation:

The proposal is to adjust the Supply/Borrow allocation from the current 70%/30% to 80%/20%.

-

Implementation Details:

Given minimal coding requirements, the proposed changes are suggested to be implemented starting from the upcoming epoch on November 30, 2023.

Community feedback on these proposed changes is warmly welcomed.